Understand what you’re really paying for—so you can protect margin, manage MOQ, and scale without surprises.

Introduction: Wholesale vs Private Label Lashes

If you’re sourcing lashes for resale, “wholesale” and “private label” can look similar on the surface—both come from a manufacturer, both arrive in trays/boxes, both can be shipped globally. The difference is how pricing is built: wholesale pricing is mostly about volume tiers on existing SKUs, while private label pricing bundles product + branding + development + minimums.

Below, we break down common lash sourcing pricing models and show how to compare quotes on a like-for-like basis (especially shipping terms and packaging).

Disclosure: we’re a factory-direct OEM/private label lash manufacturer, so examples reflect typical quote structures we see—however, costs and minimums vary by materials, packaging vendors, and shipping lanes.

Quick Answer

Wholesale lashes are priced mainly by per-tray/per-pair unit cost with quantity tiers on ready catalog styles. Private label lashes are priced as product + packaging + (often) one-time setup, and usually require higher MOQs because customization and packaging runs must be production-efficient.

Best way to compare quotes: compare landed cost per sellable unit (not just ex-factory unit price).

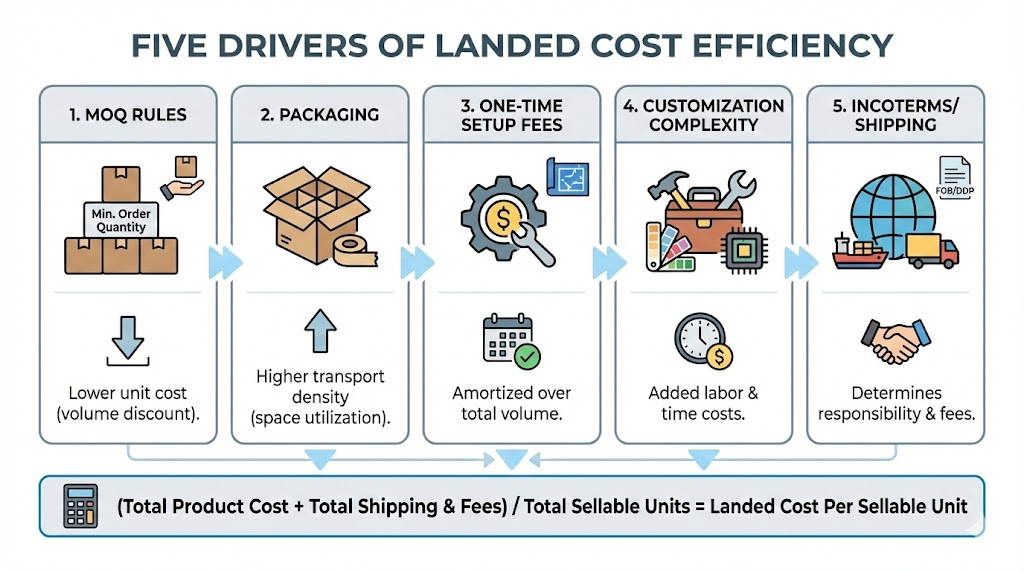

What changes the total cost most (in plain terms):

- MOQ rules: is MOQ per SKU, per style, per packaging type, or total order?

- Packaging: box material, print method, inserts, and assembly labor can exceed product cost increases.

- One-time setup fees: sampling rounds, print setup/plates, (sometimes) tooling for custom structures.

- Customization complexity: curl/length mix, band type, tray layout → affects labor time, yield, and QC.

- Shipping terms (Incoterms): EXW vs FOB vs CIF vs DDP can swing total cost more than small unit-price differences.

- Carton density/weight: how many trays fit per carton changes freight per unit.

Decision shortcut: Start wholesale to validate demand and cash flow; move top sellers to private label once specs are stable and reorders are predictable.

Disclosure: This guide reflects common quote structures we see as an OEM/private label lash manufacturer; always request itemized quotes to compare suppliers fairly.

Wholesale vs Private Label: clear definitions

Wholesale lashes (in practice) means you’re buying existing, standard styles that the factory already produces regularly. You typically choose from a catalog (curl, lengths, thickness, style), and the price is driven by volume tiers and shipping terms.

Private label lashes means you’re building a branded product line—your logo, packaging, product naming, possibly custom lash mapping/styles, and sometimes custom tray/box structure. Learn the full private label process, packaging options and MOQ here.

OEM / ODM in lash manufacturing:

- OEM (Original Equipment Manufacturer): we make to your spec (your brand, your packaging, often your customized lash styles).

- ODM (Original Design Manufacturer): we offer designs you can brand (faster, usually lower MOQ than full custom).

Citable snippet: If your priority is fast launch + lowest complexity, wholesale is usually the most cost-stable. If your priority is brand differentiation + repeatable retail presentation, private label is usually worth the extra setup and MOQ.

What actually makes up lash cost (for both models)

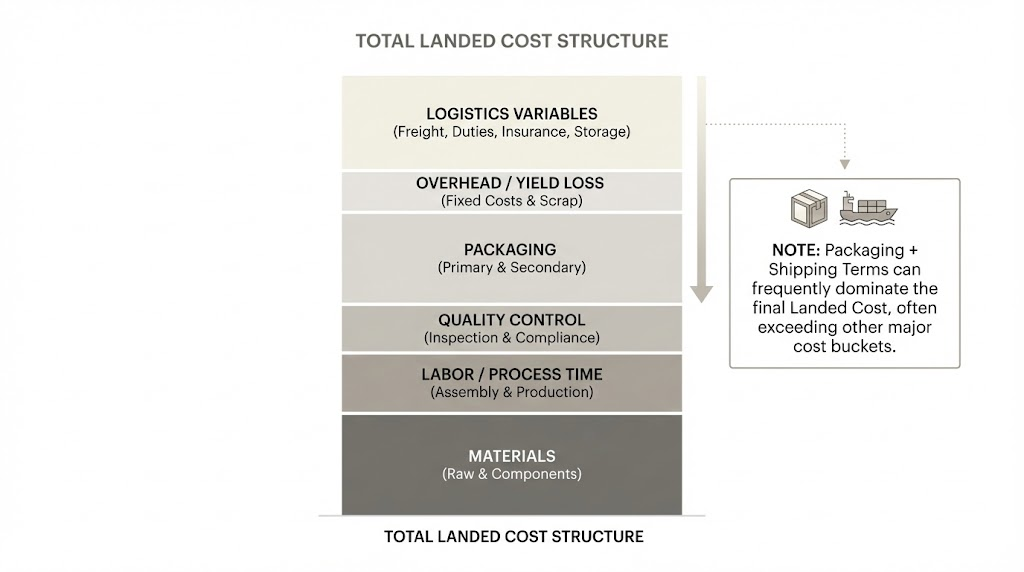

No matter the sourcing route, the factory cost is built from a few consistent buckets:

- Raw materials

- Fiber (commonly PBT), band materials, adhesives (for strip products), tray materials.

- Labor + process time

- Sorting, alignment, banding, forming, trimming, finishing.

- Quality control

- Curl consistency checks, length/diameter verification, band straightness, shedding resistance tests, visual inspection.

- Packaging

- Inner tray, outer box, inserts, labels, printing, assembly/packing labor.

- Overhead + yield

- Waste rate, rework, machine time (where applicable), utilities, admin.

- Logistics variables

- Carton size/weight, shipping method, Incoterms (EXW/FOB/CIF/DDP), duties/taxes.

What changes between wholesale and private label is how many of these costs are already “baked in” (wholesale) vs itemized and customized (private label).

Wholesale pricing models you’ll see most often

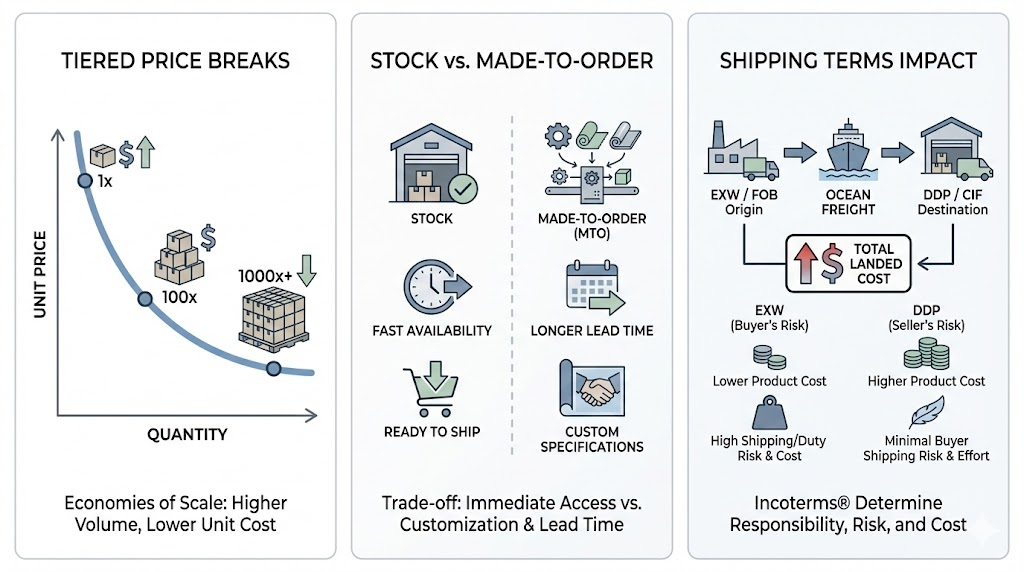

1) Tiered unit pricing (price breaks)

This is the classic model: the more you order per SKU or per total quantity, the lower the unit price. Factories do this because setup + handling per unit drops as volume rises.

What to watch:

- Are tiers based on total trays or per style/SKU?

- Are mixed styles allowed to reach a tier, or must each SKU hit the threshold?

2) “Stock” vs “made-to-order” wholesale

Even in wholesale, there are two realities:

- Stock/ready: quickest, limited customization.

- Made-to-order: same catalog styles, but produced for you (often better consistency across the batch, sometimes slightly different MOQ).

3) Shipping terms that reshape the “price”

Two suppliers can quote the same unit cost and still end up very different totals depending on:

- EXW (you handle everything from factory door)

- FOB (factory delivers to port; you manage ocean/air onward)

- CIF (supplier covers freight to port; you manage import onward)

- DDP (supplier covers most door-to-door costs; often simplest, but compare carefully)

Citable snippet: Always compare suppliers using landed cost per sellable tray/pair (product + packaging + freight + duties + local delivery), because Incoterms and carton density can change your true cost more than a small unit-price difference.

4) Assortment cartons and “bundle” wholesale

Sometimes you’ll see pricing for:

- Mixed SKU cartons (starter sets)

- Bundle pricing with tools/aftercare items

These are convenient but can hide margin weak spots if slow-moving SKUs are bundled in.

Private label pricing models (and why they look “more complicated”)

Private label pricing usually splits into one-time costs and recurring per-unit costs.

See detailed private label packaging, MOQ ranges and pricing breakdown.

One-time (or occasional) costs

- Sampling & development: sample rounds for lash style, curl, band, or tray layout.

- Printing setup: plate fees or setup fees depending on print method.

- Packaging tooling: if you need a custom box structure (less common, but possible).

- Design support: some factories charge if they do design work; others waive it at certain volumes.

Recurring per-unit costs

- Lash product cost (materials + labor + QC)

- Packaging cost (box + tray + insert + label)

- Assembly/packing labor (especially if inserts/labels are complex)

- Ongoing QC requirements (if you request tighter tolerances or extra inspection steps)

The role of MOQ in private label

MOQ isn’t just a rule—it’s the point where production becomes efficient:

- Printing has minimum runs.

- Packaging suppliers have minimums.

- Production lines are scheduled in batches.

In practice, private label MOQs may apply separately to:

- Lash style/SKU

- Packaging type

- Total order across SKUs

How to read a quote like a factory does (without needing factory math)

When we build a quote, we’re balancing three things:

- Complexity

- More steps, more handling, more QC points → higher cost.

- Volume efficiency

- Higher volume spreads fixed work (setup, admin, QC sampling) across more units.

- Risk + stability

- Tight timelines, many SKUs, or frequent small reorders can increase scheduling cost.

A simple way to compare quotes fairly

Ask every supplier to break pricing into:

- Product unit cost (per tray/pair)

- Packaging unit cost (outer box + insert + labels)

- Assembly/packing cost (if separate)

- One-time costs (sampling, printing setup)

- Incoterms and shipping assumptions

Get an accurate quote from us → Contact LashVee

If they won’t break it down, ask for two totals:

- EXW/FOB unit cost

- Estimated landed cost to your address (with shipping method specified)

Biggest cost drivers in customization (private label and “semi-custom”)

Customization is where margins are won or lost—because small choices can create real labor and QC changes.

Lash specs that move cost → Eyelash Extension Thickness Guide | Starter Lash Extensions Line SKU Guide

Lash specs that move cost

- Curl consistency requirements (tighter tolerance = more QC and sorting)

- Diameter and length mix (more unique length steps can mean more sorting/handling)

- Band type (stiffer/softer feel, different materials, different failure modes)

- Style density and symmetry (more complex patterning can reduce yield)

Tray and assortment choices

- Mixed-length trays can be great for artists, but they may require:

- extra labeling

- extra verification

- more chance of picking errors (so more QC time)

Factory insight: If you want stable quality at scale, we recommend locking a “core spec” first (fiber finish + curl family + band type), then customizing styles on top of that. It reduces variance and keeps pricing more predictable.

Packaging and branding: where private label budgets change fast

Packaging is often the most underestimated part of private label.

Full custom eyelash packaging guide (materials, structures, cost drivers, design tips)

Common packaging cost levers

- Material: cardboard, coated paper, plastic window, magnetic closure

- Print method: digital vs offset vs specialty finishes

- Finishes: foil stamping, emboss/deboss, spot UV

- Insert complexity: multi-page cards, special cutouts, care cards

- Assembly: more components = more labor

Factory insight: Packaging minimums can be higher than lash production minimums. If your lash MOQ is low but your box MOQ is high, you can end up with excess boxes—or pay a premium for short-run packaging.

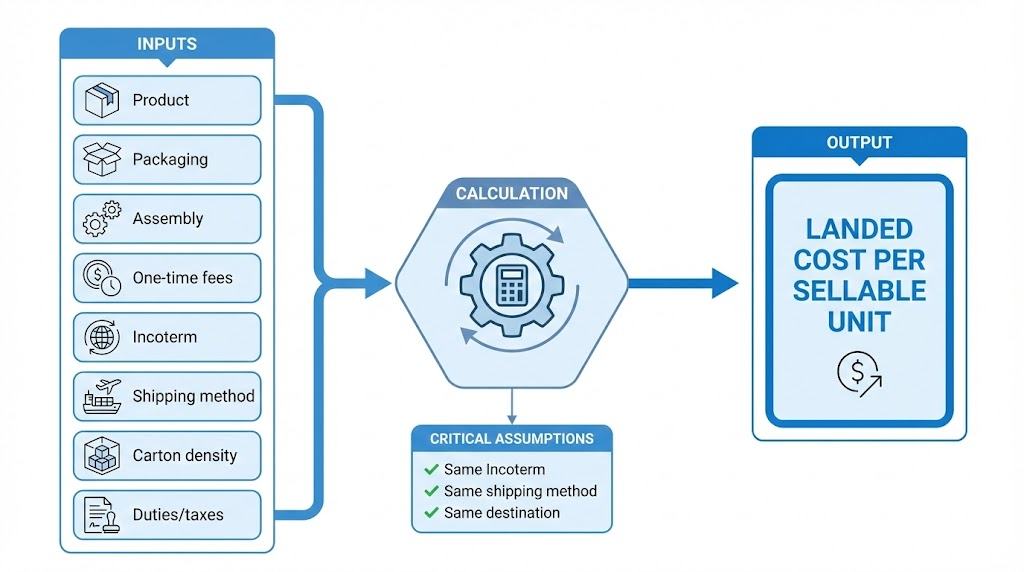

Quote normalization table: how to compare wholesale vs private label quotes fairly

Most quote confusion comes from suppliers including different things in “unit price” (product only vs product+packaging vs delivered). Use the table below to normalize every quote into the same basis: landed cost per sellable unit (tray/pair) under a defined shipping term (EXW/FOB/DDP) and shipping method (air/ocean).

Your target output: one comparable number: landed cost per sellable unit + a clear list of what’s included.

Quote normalization table (copy/paste worksheet)

| Quote line item | Wholesale quote: what you’ll usually see | Private label quote: what you’ll usually see | What to request so quotes are comparable | Common pitfalls / “gotchas” |

|---|---|---|---|---|

| 1) Product unit cost (per tray / per pair) | “$X per tray” with tier breaks by qty | “$X per tray” (often similar or slightly higher, depending on spec/QC) | Confirm the unit definition (tray vs pair), units per tray, and spec lock (curl/length/diameter/band) | Some quotes silently change tray configuration (e.g., mixed vs single length) which changes true unit economics |

| 2) Packaging unit cost (box + tray + insert + label) | Sometimes included, sometimes minimal/generic | Often itemized, or rolled into “unit price” | Ask for packaging broken out as: outer box + insert + label(s) + inner tray | Packaging is the #1 surprise cost; “unit price” may exclude inserts/labels/assembly |

| 3) Assembly / packing labor (per unit) | Often included by default (simple pack) | May be separate if multi-part packaging | Ask if assembly is included. If not: cost per unit for labeling, inserting, shrink-wrap, barcode, bundling | “Free assembly” can disappear when you add inserts, seals, or barcode steps |

| 4) One-time setup fees | Rare (unless special handling) | Common: sampling, print setup/plates, tooling (sometimes) | Request a line-item list: sampling, print setup, die-line, tooling, pre-production proofing | Some factories waive fees only at certain volumes—get it in writing |

| 5) MOQ for lashes (product) | Lower; sometimes per SKU or total | Higher; often per SKU/style | Ask MOQ for: per SKU, per style, per order total, and whether mixed SKUs count toward tier/MOQ | A low “total MOQ” can hide high per-SKU minimums |

| 6) MOQ for packaging (boxes/inserts/labels) | Low or none for generic packaging | Often higher than product MOQ | Ask packaging MOQ separately for: box, insert, labels, and whether short-run options exist | Packaging MOQ can force you to overbuy boxes or pay a premium |

| 7) Lead time | Stock: fast; MTO: moderate | Longer: approvals + packaging production | Request lead time split: production time, packaging time, approval time, shipping time | “Lead time” quoted without approvals is usually unrealistic |

| 8) QC standard / tolerances | Often implied “standard QC” | Can be stricter if you request it | Ask what QC includes + acceptable defect criteria (curl variance, band defects, labeling errors) | Tight tolerances can raise cost; unclear standards raise dispute risk |

| 9) Incoterms (EXW/FOB/CIF/DDP) | Often EXW/FOB; sometimes CIF | Often EXW/FOB or DDP if they want simplicity | Require every quote to state Incoterm + named place (e.g., FOB Ningbo, DDP Los Angeles) | Comparing EXW vs DDP is the fastest way to choose the wrong supplier |

| 10) Shipping assumptions (method + carton density) | Sometimes omitted | Sometimes included (especially DDP quotes) | Ask for shipping estimate with: air/ocean, carton size/weight, cartons per order, units per carton | “Cheap freight” estimates often assume unrealistic carton density |

| 11) Duties/taxes & clearance | Usually buyer-managed | Often included in DDP | If not DDP: ask who pays duties/taxes, who handles brokerage/clearance | DDP can be easiest but hides how costs are allocated—still normalize |

| 12) Payment terms | 30/70, 50/50, or full upfront | Similar; sometimes more deposit due to packaging spend | Ask: deposit %, balance timing, refundability of packaging run if changes happen | Payment terms affect cash flow more than small unit-price differences |

Normalization checklist (use this before you compare any two suppliers)

- Pick one comparison basis for all suppliers:

- Same Incoterm (e.g., all FOB, or all landed to your door)

- Same shipping method (air vs ocean)

- Same destination city/country

- Same unit definition (per sellable tray/pair)

- Ask every supplier for two totals:

- EXW/FOB unit cost breakdown (product + packaging + assembly)

- Estimated landed unit cost to your address (freight + duties/taxes + local delivery assumptions stated)

- Do not accept “all-in” without detail:

- If a supplier refuses line items, request the two totals above and the assumptions (carton size/weight + shipping method + Incoterm).

A decision framework: which model fits your stage?

Choose wholesale if you need:

- Fast launch with simpler buying

- Lower MOQs to test styles

- Predictable reorders with minimal changes

- Cash-flow flexibility

Choose private label if you need:

- A consistent shelf-ready brand experience

- Better long-term differentiation and customer recall

- Control over packaging, naming, and assortment strategy

- More stable repeatability once specs are locked

Hybrid path we see work well:

- Start with wholesale best-sellers

- Track what actually sells (by curl/length/style)

- Convert top performers into private label with your packaging

- Expand line only after reorders are smooth

Quick checklist: what to send a factory to get an accurate quote

Use this to avoid “surprise” costs later.

- Product type (strip / cluster / extension trays)

- Fiber/look preference (natural, bold, matte/gloss finish)

- Curl(s), lengths, diameters, and style names/SKUs

- Tray format (single length vs mixed) and units per tray

- Packaging needs: box type, size, print finish, inserts, labels

- Target order quantity (by SKU + total) and reorder expectations

- Destination country + preferred Incoterm (EXW/FOB/DDP)

- Required QC expectations (visual standards, curl tolerance priorities)

- Timeline (launch date + “must ship by” date)

Factory insight: The fastest way to lower quote variance is to provide one reference sample (or clear spec sheet) and one packaging reference (photo + dimensions). It reduces rework and shortens sampling cycles.

Common mistakes & fixes (and what to ask suppliers in writing)

These are the most common “quote traps” we see when buyers compare wholesale vs private label lash sourcing. Each fix includes a copy-paste request you can send to suppliers so your comparisons stay apples-to-apples.

Mistake 1: Comparing EXW from one supplier to DDP from another (apples vs oranges)

Why it happens: EXW and DDP are different Incoterms®—they shift who pays and who carries risk at each step of transport. The “unit price” can look cheaper simply because major costs are excluded.

Fix (standardize your comparison):

- Option A: Ask everyone for the same Incoterm (e.g., FOB) using the same destination port/airport.

- Option B: Ask everyone for landed cost to your exact address (same shipping method + same timeline).

Copy-paste request (supplier message):

- “Please quote this order on FOB [Port] and also provide an estimated landed cost to [City, Country/ZIP] via [Air Express / Air Freight / Ocean]. Include carton count, carton dimensions, gross weight, and any assumptions.”

Citable takeaway: Incoterms® define buyer/seller obligations, costs, and risk allocation—so EXW vs DDP prices aren’t directly comparable unless you normalize to the same term or to landed cost.

Mistake 2: Customizing everything at once (spec + styles + packaging + finishes)

Why it happens: Too many moving parts at the start increases revisions, delays approvals, and makes it hard to diagnose what’s driving cost or quality variance.

Fix (lock the “core spec” first):

- Lock a core spec (fiber finish + curl family + band type + tray format).

- Run 1–2 reorder cycles with no spec changes.

- Only then expand styles, lengths, and premium packaging finishes.

Copy-paste request:

- “Let’s lock one core spec for the first order. Please confirm the exact curl standard, band material/type, fiber finish, and tray layout in the proforma + sample approval sheet.”

Citable takeaway: Freeze one core spec first; iterate styles and packaging after you’ve proven reorder stability.

Mistake 3: Underestimating packaging MOQ (and discovering it’s higher than lash MOQ)

Why it happens: Custom packaging often has MOQs because setup time, materials waste, and run efficiency don’t scale down smoothly for tiny runs.

Also, print method matters: offset printing uses plates, which adds setup overhead, while digital printing typically doesn’t require plates, making short runs more feasible.

Fix (separate packaging math from lash math):

- Ask for two MOQs: (1) lash production MOQ and (2) packaging MOQ (box/insert/label).

- Start with a standard box structure + custom print (lowest complexity), then upgrade finishes (foil/emboss/magnet) after traction.

- If you’re testing many SKUs, consider short-run packaging first (often digital), then move to higher-efficiency methods at volume.

Copy-paste request:

- “Please list MOQ separately for: (a) lash trays per SKU, (b) outer box, (c) inserts, (d) labels. Also specify printing method (digital/offset) and any setup fees.”

Citable takeaway: Packaging MOQ often exists because of setup + waste + run efficiency—and print method (plate-based vs plate-free) can change the economics of small runs.

Mistake 4: Launching too many SKUs too early (inventory drag + QC load)

Why it happens: More SKUs increases operational complexity (forecasting, purchasing, picking/packing, QC variation), which can hurt performance if demand is not proven. Research on product/SKU proliferation links higher SKU counts to higher complexity and negative performance effects in many contexts.

Fix (tight assortment + expand from winners):

- Start with a small “core” assortment (e.g., best-selling curls/lengths).

- Use reorder data to expand only the proven winners.

- Add variants (length mix, density, packaging tiers) only after stable sell-through.

Copy-paste request:

- “We’re starting with [X] SKUs max for launch. Please optimize quote and lead time around repeatable reorders of these SKUs.”

Citable takeaway: SKU proliferation increases complexity—start tight, then expand from proven sellers.

Mistake 5: No written QC acceptance criteria (leading to disputes and inconsistent batches)

Why it happens: Without written acceptance standards, “quality” becomes subjective at delivery—especially with curl tolerance, band alignment, shedding, and cosmetic defects.

Fix (define acceptance before production):

- Define defect classes (e.g., Critical / Major / Minor)

- Define inspection approach (e.g., AQL-based sampling) and inspection level

- Define “what counts as a defect” with photo examples and measurement tolerances

If you want a recognized framework to reference, ISO 2859-1 and ANSI/ASQ Z1.4 are widely used acceptance sampling systems for attribute inspection using AQL concepts.

Copy-paste request:

- “Please confirm the QC acceptance criteria in writing: defect definitions (critical/major/minor), sampling method (AQL level), inspection checkpoints, and photo standards for curl/band alignment/shedding.”

Citable takeaway: Agree on written defect standards and an AQL-style sampling plan before production to reduce disputes and batch-to-batch variation.

FAQ

Is private label always more expensive than wholesale?

Usually the first private label order costs more because you’re paying for packaging setup and development. Over time, if volume is consistent, private label can become cost-efficient because your spec stabilizes and you optimize packaging runs.

Can we private label with low MOQ?

Often yes—but “low MOQ” depends on what’s being customized. Custom box structures and specialty finishes typically force higher packaging minimums. A practical low-MOQ strategy is standard box structure + custom print.

What’s the biggest hidden cost in lash sourcing?

Packaging complexity and shipping assumptions. Also, frequent micro-changes (logo placement, insert edits, SKU swaps) can create extra rounds of rework and delays.

Does customization affect quality?

It can—mainly because complexity increases the number of steps and inspection points. Preventing common defects starts with clear specs and consistent handling.

If we sell lash glue too, does that change anything?

Yes—adhesives and compliance claims introduce extra risk and documentation needs. Keep product claims conservative and aligned with regulations.

Key Points

- Wholesale pricing is typically tiered on existing SKUs; private label pricing includes branding and development layers.

- Compare quotes by landed cost, not just unit price.

- Private label costs are driven heavily by packaging MOQ, print method, and assembly steps.

- Customization changes cost through labor time, yield, and QC intensity.

- A hybrid sourcing plan often balances speed (wholesale) and differentiation (private label).

- Lock a core spec first to keep quality stable and pricing predictable.

- Fewer SKUs early on usually means higher inventory efficiency and smoother reorders.

- Factory-direct pricing works best when specs, quantities, and shipping terms are clearly defined.

Conclusion

Wholesale and private label aren’t “better vs worse”—they’re different pricing structures built for different business stages. Wholesale is the fastest way to validate demand with low friction. Private label is the best way to build brand memory and retail consistency once you know what sells.

If you want, we can help you map a cost plan for both routes—starting with a lean wholesale assortment, then converting the top sellers into private label with customized lash styles, stable quality controls, and a low-MOQ packaging approach (factory-direct).

Get your personalized quote today | Explore OEM/ODM services

Reference list

[1] International Chamber of Commerce (ICC). Incoterms® 2020. ICC.

[2] UPS Supply Chain Solutions. Incoterms Definition (Incoterms® rules responsibilities, costs, risk). UPS.

[3] DHL. What is Landed Cost? Meaning, formula & calculation (includes shipping, insurance, customs/duties). DHL.

[4] International Organization for Standardization (ISO). ISO 2859-1:2026 — Sampling procedures for inspection by attributes (AQL-based acceptance sampling). ISO.

[5] American Society for Quality (ASQ). ANSI/ASQ Z1.4 & Z1.9 Sampling Plan Standards for Quality Control (Z1.4 acceptance sampling by attributes; AQL). ASQ.

[6] Xerox. What is digital printing? (digital printing does not require printing plates). Xerox.

[7] Encyclopaedia Britannica. Printing — Offset plate making. Britannica.