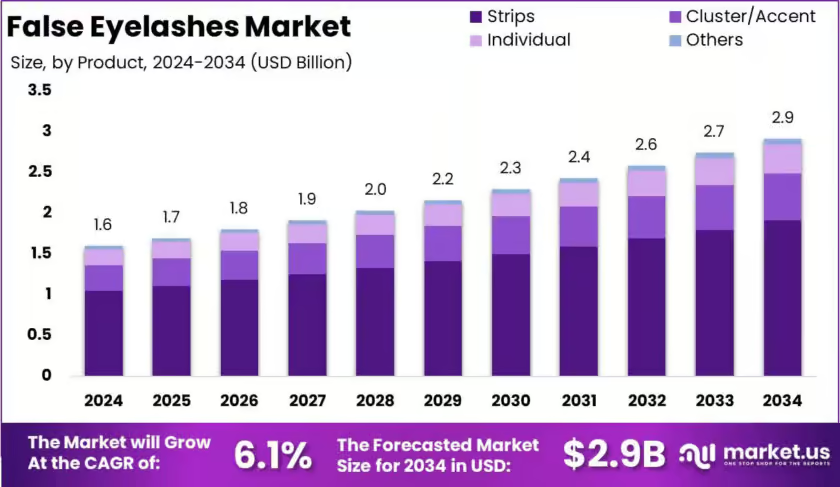

Lash demand looks strong, but many buyers and founders still lose money through wrong positioning, unstable suppliers, and rising acquisition and compliance costs. This guide clarifies profit drivers.

Yes, the lash business can still be profitable in 2026, but profit concentrates in models with repeat purchases, controlled product quality, and predictable unit economics. Businesses that rely on one-time viral sales or inconsistent production struggle to sustain margins.

Profit in lashes is not a single number. In manufacturing, I see “profitable” brands and studios defined by three controls: (1) retention and reorder cadence, (2) cost stability through specification and process control, and (3) risk control in safety, claims, and compliance. 2026 is a mature market. That maturity rewards operators who run lashes like a supply chain business, not a trend.

Which lash business models make money in 2026?

Many people enter lashes assuming “high markup” equals “high profit,” then discover that low retention, refunds, or ad costs remove the margin. The solution is choosing a model that fits repeat demand and operational control.

In 2026, the most profitable lash models are those that combine recurring revenue (fills or reorders), standardized SKUs, and tight quality specifications. Studios win through retention and scheduling efficiency. Product brands win through repeatable hero SKUs, controlled COGS, and disciplined acquisition costs.

Dive Deeper in Lash Business

From a factory perspective, the lash category is really several categories operating under one keyword: professional extensions, strips, clusters, and accessories (adhesives, tweezers, aftercare). Each has a different profit engine.

For service businesses (lash studios and independent artists), profit is primarily a scheduling and retention problem. A fill cadence (often every 2–4 weeks) creates predictable demand, but only if retention is stable and the service time stays consistent. In production terms, the studio is “assembling” a look in real time, so labor efficiency is the largest variable. The operators who do well in 2026 typically standardize mapping options, limit overly complex custom sets, and control rebooking systems. When service time drifts upward or clients return irregularly, the effective hourly margin collapses.

For product brands, profitability depends on repeatable SKUs and low variance manufacturing. Lashes look simple, but small changes in fiber diameter, taper consistency, curl set stability, and band stiffness can change the customer experience enough to increase returns or reduce reorder. The most stable brands focus on a small number of core styles with tight specs and consistent batch control, rather than launching dozens of designs. This is especially true for clusters and DIY systems, where consumers now compare usability, comfort, and wear time across many competing kits.

A practical way to compare models is to separate “recurring demand” from “one-time demand”:

| Model | Main revenue driver | Repeat cadence | Biggest margin risk |

|---|---|---|---|

| Lash studio (in-chair) | Fills + memberships | High | Labor time, retention, local price pressure |

| Solo artist (suite/mobile) | Fills + referrals | Medium–high | Utilization, cancellations, supply inconsistency |

| DTC strip/cluster brand | Reorders of hero SKUs | Medium | CAC volatility, returns, inconsistent batches |

| Wholesale/distributor | Volume + assortment | Medium | Cashflow, inventory aging, supplier stability |

| OEM/private label brand owner | Brand + channel control | Medium–high | Spec control, compliance, forecasting errors |

In supplier evaluation, I advise buyers to match their model to what the factory can control. A manufacturer-led approach (like ours at LashVee) matters because profitability is usually lost in inconsistency: curl drift, uneven taper, variable band adhesion, or packaging defects that trigger chargebacks. Process transparency, batch records, and clear incoming/outgoing QC reduce rework and stabilize gross margin over time.

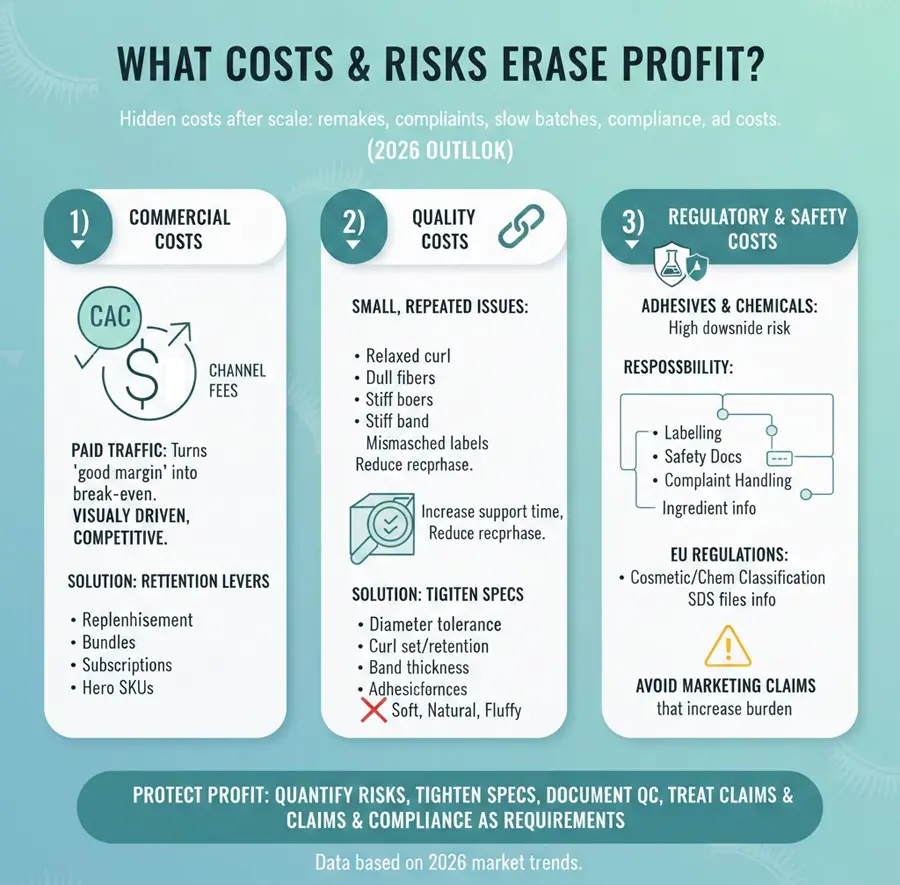

What costs and risks most often erase profit?

Many lash businesses “sell well” but still struggle because hidden costs show up after scale: remakes, complaints, slow batches, compliance requests, and ad costs. The solution is to quantify these risks before growth.

In 2026, the most common profit killers are customer acquisition cost volatility, inconsistent product batches, and avoidable remakes or refunds driven by comfort, retention, or allergy concerns. Businesses protect profit by tightening specs, documenting QC, and treating claims and compliance as operational requirements.

Dive Deeper

In manufacturing, I categorize margin loss into three buckets: commercial costs, quality costs, and regulatory or safety costs.

1) Commercial costs (especially CAC and channel fees)

For product brands, paid traffic can turn a “good margin” product into a break-even business. Lash products are visually driven and competitive, which often increases the cost to acquire a buyer. In 2026, brands that survive typically rely less on constant paid acquisition and more on retention levers: replenishment reminders, bundles, subscriptions, and a limited set of hero SKUs that customers repurchase.

2) Quality costs (returns, remakes, inconsistency)

Quality problems rarely appear as “one big defect.” They appear as small, repeated costs: a curl that relaxes earlier than expected, fibers that look dull in one batch, a strip band that is too stiff for certain eye shapes, or tray labels that mismatch the actual curl. Each small inconsistency increases customer support time and reduces repurchase rates.

From a factory standpoint, these issues are controllable, but only if the buyer specifies measurable standards. “Soft,” “natural,” and “fluffy” are not production specs. Diameter tolerance, curl set method, curl retention checks, band thickness range, and adhesive performance conditions are production specs.

3) Safety, claims, and compliance costs

Adhesives and chemicals create the highest downside risk. Even when a business does not manufacture adhesives, it can still be responsible for labeling, safety documentation, or complaint handling depending on the market and channel. In the EU, cosmetic-related regulation and chemical classification frameworks matter, and buyers should understand how lash glues and their ingredients are treated and documented. In practical terms, this means keeping SDS files, ingredient information where applicable, and avoiding marketing claims that trigger higher regulatory burden.

A simple internal control table helps founders keep profit visible:

| Cost/Risk | What it looks like in reality | What to control |

|---|---|---|

| CAC spikes | Same sales, higher ad spend | Retention flows, bundles, repeat SKUs |

| Remakes | “Retention issue” or “too heavy” | Lash weight mapping, adhesive SOP, product consistency |

| Returns/chargebacks | Defects, wrong labeling, broken packaging | Incoming QC, packaging drop tests, batch traceability |

| Compliance requests | Marketplace takedowns, border delays | Documentation pack, consistent labeling, supplier disclosures |

When I evaluate suppliers, I look for production discipline more than marketing. A stable manufacturer provides process visibility (curl setting, fiber prep, band assembly), batch-level QC records, and clear acceptance criteria. That infrastructure lowers long-term costs because it reduces surprise defects and makes scaling predictable.

How do you evaluate a lash supplier for stable margins?

Many buyers focus on price per tray, then discover that inconsistent quality, late deliveries, or unclear documentation costs more than the “savings.” The solution is to evaluate suppliers like a production partner.

A reliable lash supplier in 2026 is defined by material traceability, controlled curl and taper specifications, repeatable band construction, and documented QC. Stable margins come from low variance production, not from chasing the lowest unit price.

Dive Deeper

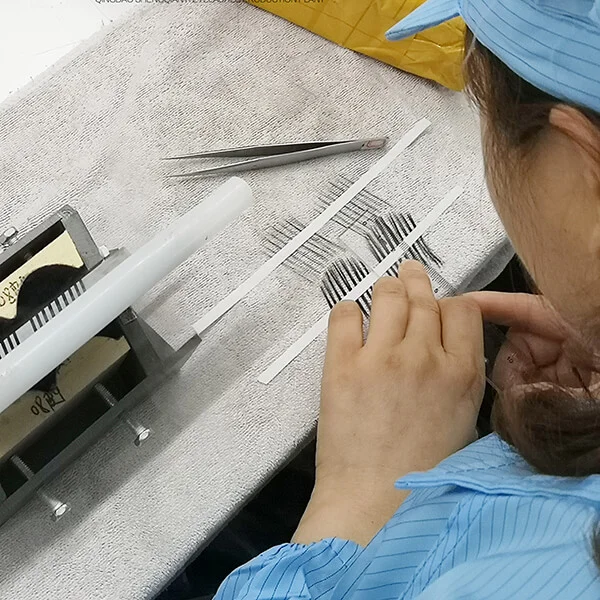

From the manufacturer side, “supplier selection” is really “process selection.” Two factories can offer the same style name, but produce materially different outcomes because the process controls differ.

Material control and fiber consistency

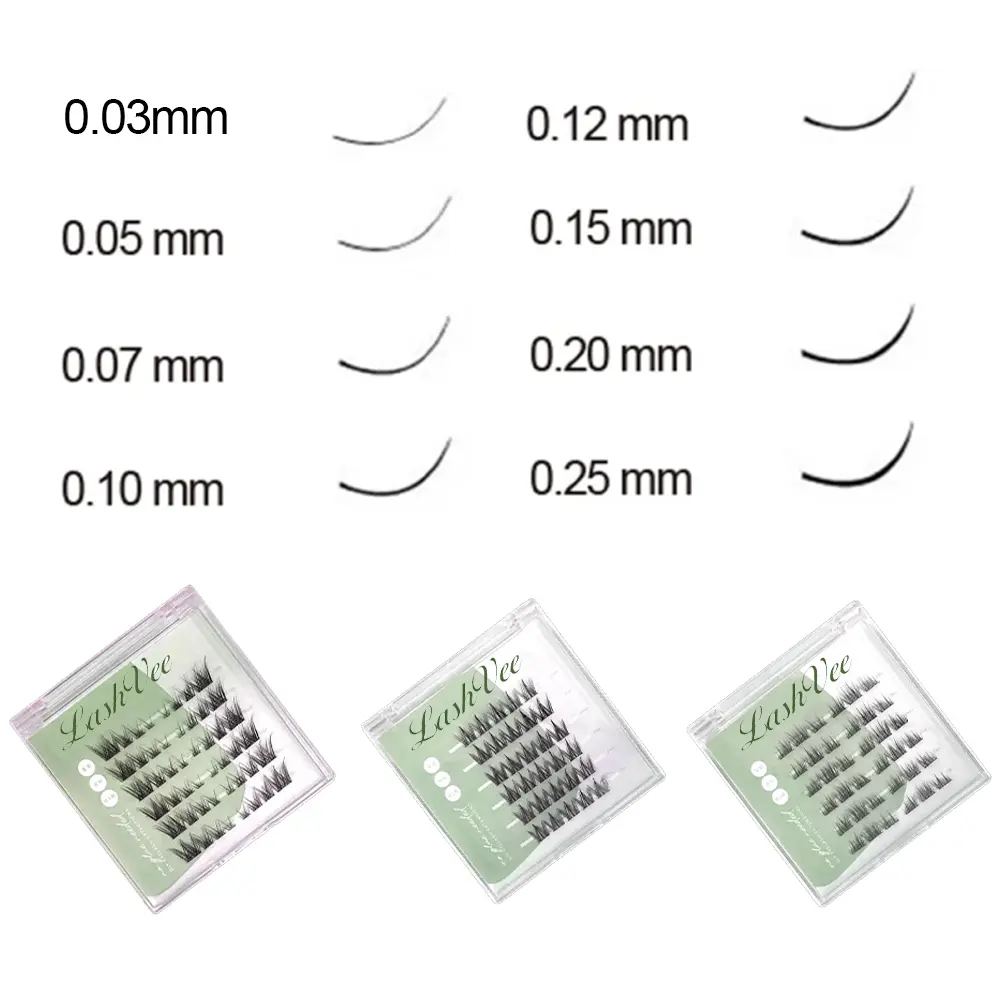

Most professional lash extensions use synthetic fibers, commonly discussed in the industry as PBT-based materials. What matters for performance is not the label but the execution: fiber diameter consistency, taper uniformity, surface finish, and curl stability after heat setting. If the raw fiber lot changes or the curl-setting parameters drift, your customer notices as poor retention, harsh feel, or inconsistent appearance. A supplier should be able to explain how they control raw material lots, what they test on incoming fiber, and how they validate curl retention.

Curl, length, and mapping tolerance

Buyers often underestimate tolerance. A “D curl 0.07” that varies even slightly can change fan behavior for artists and change the final look for consumers. In manufacturing, that means a supplier must define tolerance bands and sampling plans. If a factory cannot articulate tolerance and inspection steps, the buyer will carry that cost later as complaints.

Band construction and durability (for strips and clusters)

Band stiffness, thickness, and adhesive bonding are the functional core of strip lashes and many cluster products. A supplier should have repeatable band assembly steps, bonding strength checks, and packaging that protects deformation in transit. Packaging failures are not “cosmetic”; they create returns.

Process transparency and corrective action

In OEM/ODM work, profit stability comes from fast problem resolution. I recommend asking for:

- A documented production flow (fiber prep → curl set → sizing → assembly → QC → packing)

- Batch traceability (lot IDs on trays/cartons)

- A QC checklist with measurable criteria (not only visual descriptions)

- A corrective action loop: what happens when a defect is found, and how it is prevented next time

This is where a manufacturer-led approach like LashVee’s reduces risk. We focus on production control, specification clarity, and repeatability because that is what keeps a buyer’s unit economics stable across seasons and scaling phases. Trend-driven suppliers can ship good samples, but they often fail on consistency when volume increases or when raw material availability changes.

Conclusion

The lash business can still be profitable in 2026, but profit is earned through retention, disciplined unit economics, and low-variance production. Studios win by standardizing service time and keeping rebooking stable. Product brands win by focusing on a few repeatable hero SKUs and controlling quality and compliance risks through a transparent, process-driven manufacturer.

References

- Grand View Research. (n.d.). False eyelashes market size, share & trends analysis report. https://www.grandviewresearch.com/industry-analysis/false-eyelashes-market

- Technavio. (n.d.). False eyelashes market analysis (forecast 2025–2029). https://www.technavio.com/report/false-eyelashes-market-industry-analysis

- Future Market Insights. (2025, August 5). Lash extension market size and forecast (2025–2035). https://www.futuremarketinsights.com/reports/lash-extension-market

- Federal Reserve Bank of St. Louis (FRED). (n.d.). Personal consumption expenditures: Personal care and clothing services (DPERRC1A027NBEA). https://fred.stlouisfed.org/series/DPERRC1A027NBEA

- Federal Reserve Bank of St. Louis (FRED). (n.d.). Personal consumption expenditures: Personal care (DPCRRC1A027NBEA). https://fred.stlouisfed.org/series/DPCRRC1A027NBEA

- European Union. (2009). Regulation (EC) No 1223/2009 on cosmetic products. EUR-Lex. https://eur-lex.europa.eu/eli/reg/2009/1223/oj/eng

- European Chemicals Agency (ECHA). (n.d.). Ethyl 2-cyanoacrylate: Substance overview / dossier information. https://echa.europa.eu/es/information-on-chemicals/registered-substances/-/disreg/substance/external/100.027.628/7/9/1

- Allure. (2025). Best at-home lash extensions that actually last. https://www.allure.com/story/best-at-home-lash-extensions

- Byrdie. (2025). Is the lash extensions era over?. https://www.byrdie.com/is-the-lash-extensions-era-over-11806209

- The Wink Lab. (2024, December 23). What are eyelash extensions made of?. https://www.thewinklab.com/post/what-are-eyelash-extensions-made-of